inheritance tax malaysia

However this legislation was repealed in 1991. Inheritance Inheritance tax and inheritance law in Malaysia Taxation Researcher April 04 2022 INHERITANCE No inheritance or gift taxes are levied in Malaysia.

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

Currently Malaysia does not have any form of death tax estate duty or inheritance tax.

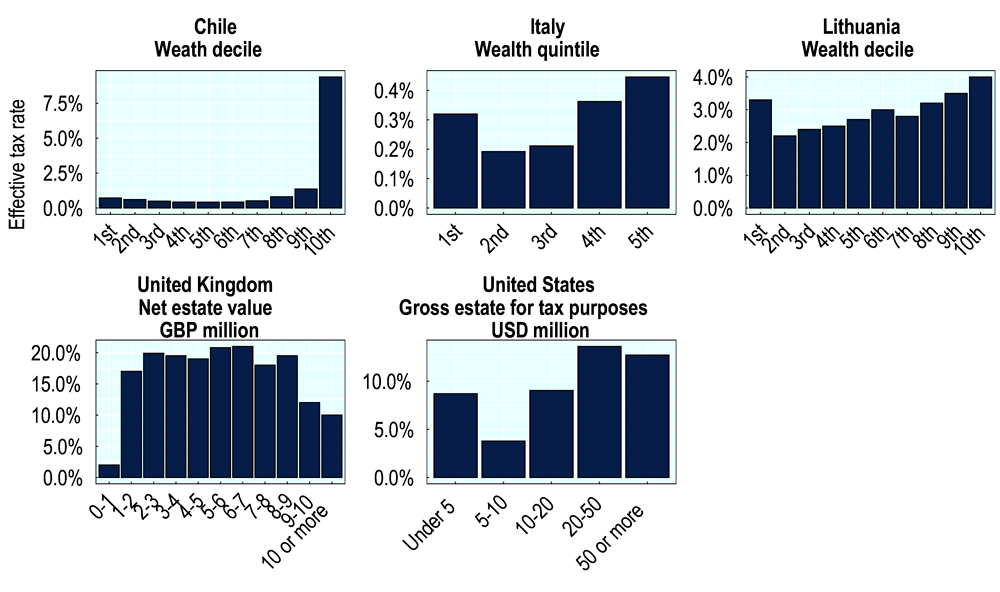

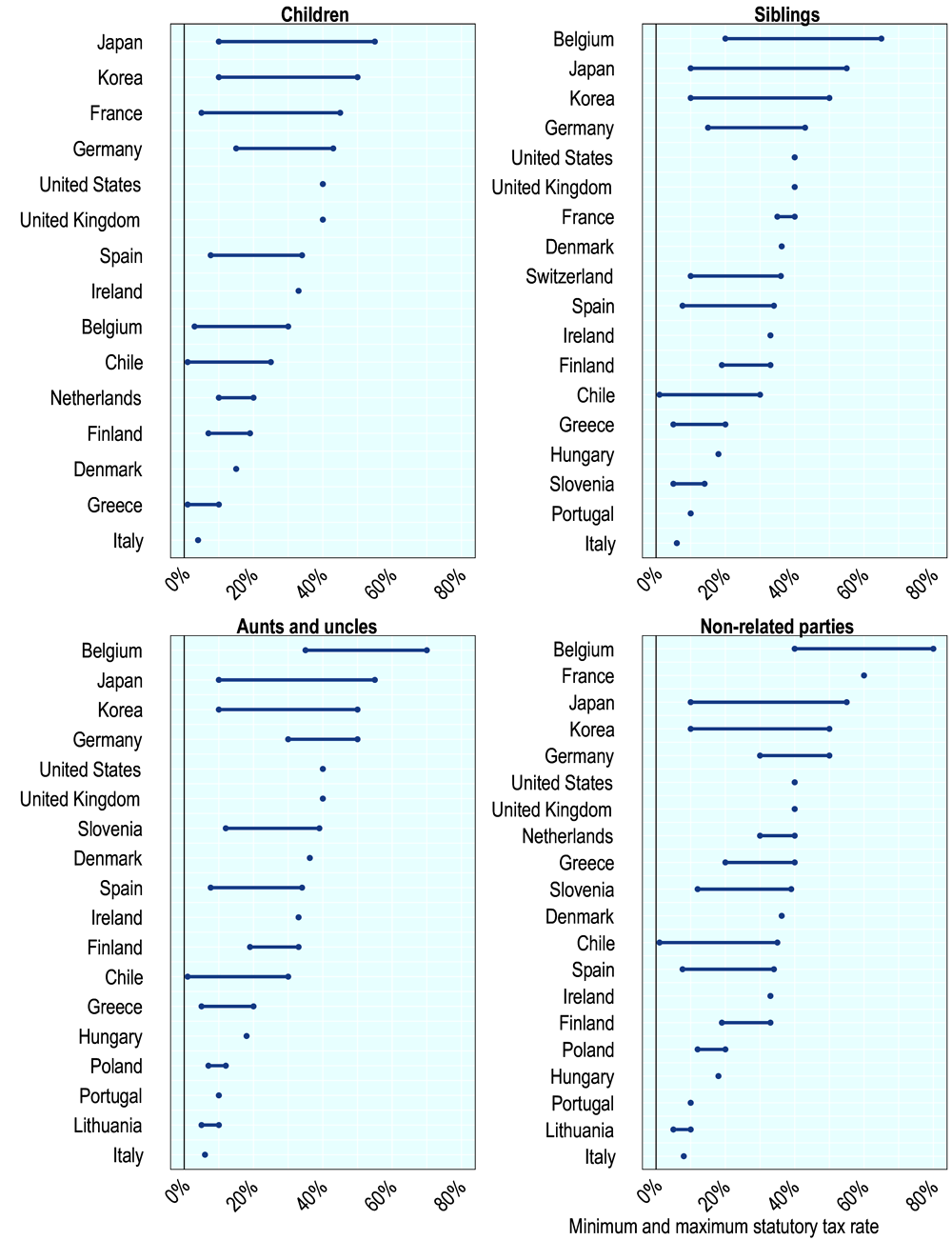

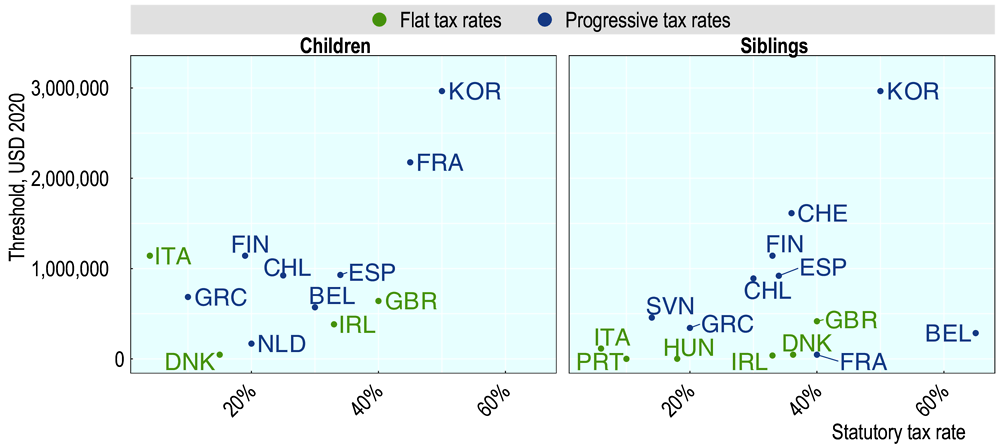

. Malaysian Government has doubled the minimum value of properties that foreign interests could buy to RM1 million from RM500000 currently as listed down in the Table below for the Penang Johor and Federal Territory of Kuala Lumpur Labuan and Putrajaya. According to the US-based The Tax Foundation as of 2015 the estate or inheritance tax to lineal heirs in Japan was 55 South Korea 50 France 45 UK 40 USA 40 Spain 34 and Ireland 33. We do not have the inflation rate of Malaysia from 1977 until 2020 but for arguments sake we will use a prudent rate of 35.

By compounding this 35 rate annually for 43 years the minimum value of the property from RM20000 in. Whether that it in equal share have to check the Distribution Act in details. By imposing an inheritance tax on properties the Government is effectively imposing a tax on the inflation suffered by the house buyer.

Its only charged on the part of ones estate thats above the threshold. In addition UK. Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax.

Consider the following example of Tan who bought a property in 1977 for about RM20000. There was an estate duty in place until 1 November 1991 when it was abolished. At the time assets of a deceased individual valued beyond RM2 mil was subject to an estate tax between 05 and 10.

An estate of a deceased was liable to a five per cent tax if it was valued above RM2 million and 10 per cent if it was above RM4 million. There is currently no tax for property inheritance in Malaysia. At the time of his death the value of the property is.

Malaysia - More data and information How high is income tax on residents in Malaysia. Duty to notify and posthumous assessments. However in recent years there have been talks of reintroducing inheritance tax by successive governments.

As of Budget 2020 no new laws on inheritance tax have been. 1 This Act may be cited as the Inheritance Family Provision Act 1971. Inheritance estate and gift taxes.

Even if there are no difficulties with having many beneficiaries or with finding them the application of the intestacy law in Malaysia will create other difficulties as shown below be it the Distribution Act 1958 or the Intestate Succession Ordinance 1960. There are no inheritance estate or gift taxes in Malaysia. 2 This Act shall apply throughout Malaysia but shall not apply to the estates of deceased Muslims or natives of any of the States in Sabah and Sarawak.

He subsequently got married and stayed in the same property until his demise in 2020. Property prices in Malaysia. Excise duties are imposed on a selected range of goods manufactured and imported into Malaysia.

In addition the intestate will not be able to dictate the terms of the distribution of their estate to the people chosen to be beneficiaries. This means that in Malaysia there is no final tax on the accumulated wealth of a deceased individual. During that time net worth assets exceeding RM2 mil were taxed at 5 and 10 on net worth assets exceeding RM4 mil.

Gifts made three to seven years before your death that are above the threshold are taxed on a. Goods that are subject to. Graph of house price trends in Malaysia Where to by property in Malaysia.

Its previous version was revoked back in 1991. Elaborating on capital gains tax Koong said the new proposed tax system would spook. See the Other taxes section in the Individual tax summary.

Has inheritance tax to be paid whereas Malaysia has zero inheritance tax payable which facilitates ease of distribution of ones Malaysian estate. If theres inheritance tax to pay its charged at 40 on gifts given in the three years before you die. However it was abolished 1991.

151 rows The standard inheritance tax rate is 40. Inheritance tax in Malaysia was abolished back in 1991. There is currently no inheritance tax in Malaysia.

Property tax is levied on the gross annual value of property as determined by the local state authorities. Children are entitled to the whole share if your mum pass away leaving only the three of you. The prime reason was due to poor tax collection as the tax was only applicable to a specific threshold and was only applicable when a person died.

In this Act unless the context otherwise requires-- annual income means in relation to the net estate of a deceased person the. Under the Distribution Act should your mum pass away leaving three children and your dad and no parents your dad is entitled to 13 of the share and the three children 23. An inheritance tax was implemented in Malaysia under the Estate Duty Enactment 1941.

The quick answer is no. Do you have to pay tax when you inherit your share of your inheritance. Our specialisation in estate planning for both jurisdictions has enabled us to assist many clients to plan ahead their estates for each country to prevent delay in execution and.

THE launch of the Shared Prosperity Vision 2030 signalled a new era of development in Malaysia. Luxury and excise duties.

On Last Few Weeks 20hb July Sell Back Physical Gold Bar With Affin Bank The Bank Buy Back Policy And Procedure Quite Simple Com Physics Gold Bar Finance Tips

Inheritance Taxation In Oecd Countries En Oecd

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Bkash Mobile Money Job Opening Good Communication Skills Job

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

白金地产广告展板背景板 City Photo Photo Aerial

Budget 2020 It S Time For Wealth And Inheritance Tax

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Understanding Inheritance And Estate Tax In Asean Asean Business News

Tax Experts No Need For Capital Gains Inheritance Taxes

Is Inheritance Tax Payable When You Die In Singapore Singaporelegaladvice Com

1 Nov 2018 Budgeting Inheritance Tax Finance

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

1 Nov 2018 Budgeting Inheritance Tax Finance

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

0 Response to "inheritance tax malaysia"

Post a Comment